Understanding Fixed Asset Accounting: A Complete Overview

August 28, 2024, 0 Comments

These assets, which are often equipment or property, provide the owner with long-term financial benefits. A business is expected to keep and use fixed assets for at least one year. The fixed asset accounting value of fixed assets declines as they are used and age — except for land — so they can be depreciated. Fixed assets are often converted into cash at the end of their life cycle.

- Over its useful life, the printer would gradually decapitalize itself from the balance sheet.

- This ratio could also be helpful internally for budgeting and investment strategy.

- While they may handle standard situations, they struggle with additional complexities.

- Fixed assets, also known as capital assets, are long-term resources held by a company for business operations.

- The fixed asset turnover ratio measures how efficiently a company utilizes its fixed assets to generate revenue.

- For example, an airplane will be a fixed asset for an airline, and a bus will be a fixed asset for a transportation company.

Intangible Assets

If an asset meets both of the preceding criteria, then the next step is to determine its proper account classification. Over the past few weeks, sterling has been raised by better than expected economic growth and interest rate forecasts, and political stability with the new government. A study by the University College London found the majority of women only started looking for information about the menopause once their symptoms had started. Whether that’s climate controlled bedsheets, a skin care line or specific electrical equipment, the aim is to help women identify products more easily – while also boosting brand credibility and trust.

Classification and Depreciation of Fixed Assets

These assets are not intended for resale but rather for continued use within the business to support its operations. Because they provide long-term income, these assets are expensed differently than other items. Tangible assets are subject to periodic depreciation while intangible assets are subject to amortization.

Presentation of Fixed Assets

The company then will depreciate these assets over the five-year period to account for their cost. The depreciation expense is moved to the income statement where it’s deducted from operating profit. Depending on what the asset is used for, this expense may be shown in cost of goods sold or in the selling, general and administrative category. Net fixed assets are a crucial indicator of a company’s long-term asset value, reflecting the current worth of essential assets after depreciation and improvements.

CapEx ratio

- The seller has a claim on the buyer’s cash until the buyer pays for the goods or services.

- For instance, if a building’s original cost is reduced by depreciation, the remaining value is part of net assets.

- This yields a monthly depreciation charge, for which the entry is a debit to depreciation expense and a credit to accumulated depreciation.

- When this is the case, record a loss in the amount of the difference, which reduces the carrying amount of the asset.

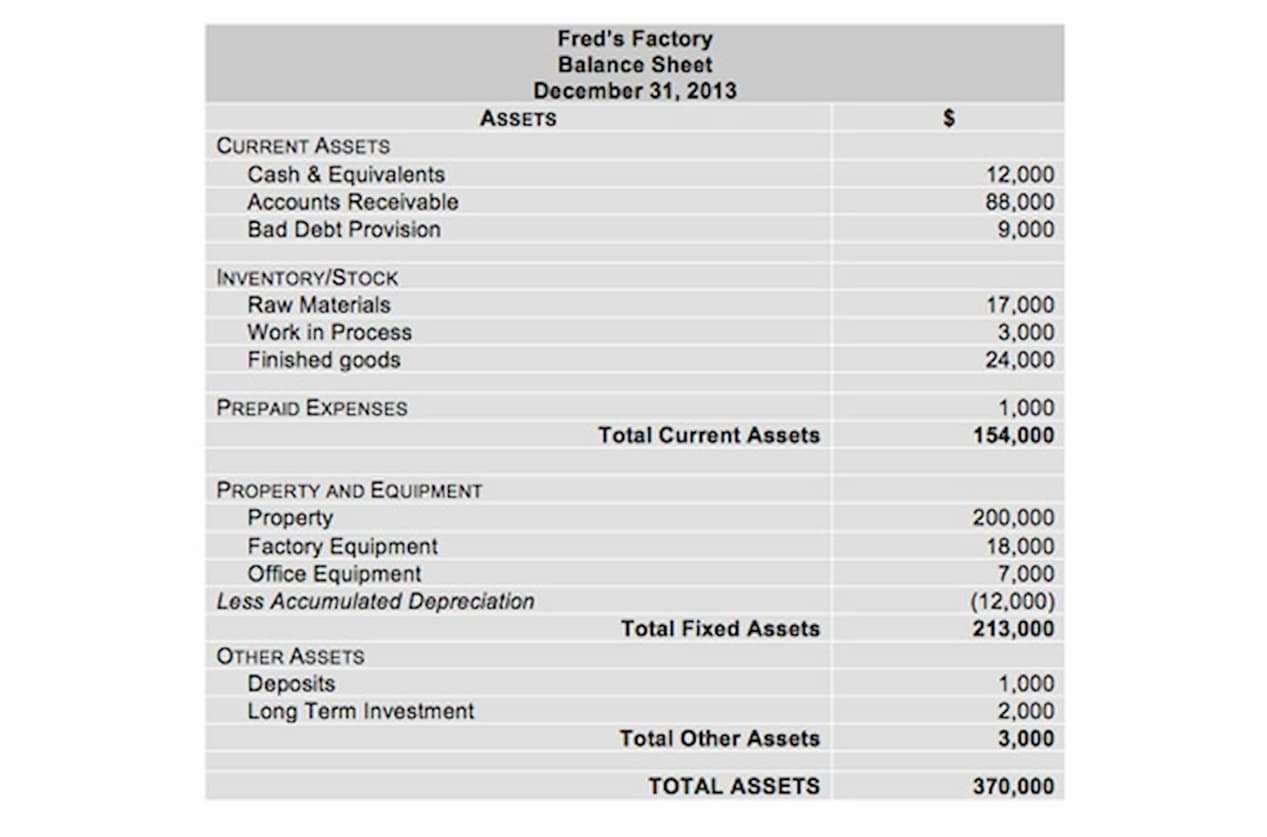

- Fixed assets are recorded on the balance sheet and affect the asset side by representing the company’s investments in long-term resources, influencing its overall financial position.

- Regardless, an impairment should be recorded once a triggering event becomes known, not at the time of routine impairment testing.

Fixed assets are physical or tangible items that are purchased by the business, support its operations, and have a monetary value. It’s crucial for companies to accurately track and manage their fixed assets in order to maintain long-term profitability and success. That makes optimizing the processes for handling your fixed assets essential. Organizations may present fixed assets in a number of different ways on the balance sheet. Conversely, they could also be presented as the gross value of total fixed assets along with the accumulated depreciation recognized to date, aggregated to their net value.

Accumulated Depreciation and Carrying Value

Fixed assets

- Investors closely monitor this ratio in the following years to see if the company’s new fixed assets lead to increased sales.

- The furniture and fixtures account is one of the broadest categories of fixed assets, since it can include such diverse assets as warehouse storage racks, office cubicles, and desks.

- Currently, landlords can rent out private homes if they meet the energy performance certificate E, while social rented homes have no minimum energy efficiency standards.

- The cost of new fixed assets will likely increase due to normal inflation, while depreciation is calculated using historical costs.

0 Comments