Your cart is currently empty!

At Debts, we try so you’re able to build economic choice with full confidence. Even though of your points examined come from the firms, and other people that have which our company is associated and people which make up us, all of our feedback won’t be dependent on him or her.

DCU also offers both household collateral finance and you may HELOCs. The fresh subsections lower than possess types of here is how these items works and you will degree into DCU’s devices factors.

That is DCU?

DCU try chartered into the 1979 indeed its now among state’s 20 premier borrowing from the bank unions. An option to its develops is actually helping due to the fact credit relationship to over 700 companies and teams. Of stretching membership certificates to help you selection of these companies and you may groups along with their family members, DCU will bring provided a more impressive quantity of users all over the nation.

People winnings if they have even more alternatives. And additionally banking institutions, borrowing from the bank unions portray ideal for certain kinds of credit. Specifically, brand new Digital Government Credit Connection (DCU) has the benefit of extra choices for customers looking property Shelter Financing otherwise a home Make sure Credit line (HELOC).

Borrowing unions are usually thought of as local, community-centered groups. DCU has grown one to design towards electronic years by using its on the web visibility in order to suffice over so many participants around the all of the fifty says. See DCU qualifications web page to see a great selection of having fun with businesses.

Credit unions will bring best company than simply finance companies because they’re maybe not-for-finances organizations. They are payday loan Kensington Park owned by brand new pages, thus unlike creating income getting outside investors, it manage bringing most useful monetary terms and conditions with the somebody.

DCU’s large registration eligibility conditions help to make it credit union commonly readily available. That can well cause them to a good idea proper provided good house Be sure Financial support otherwise a good HELOC.

- Manage DCI provide house safeguards money if you don’t HELOCs?

- DCU household be sure financial

- DCU HELOC

- Simple tips to get DCU household members security funds

- DCU specialist and you may associate studies

- DCU pros

- DCU drawbacks

- DCU alternatives

Key points to take on When looking for A good DCU Domestic Collateral Capital

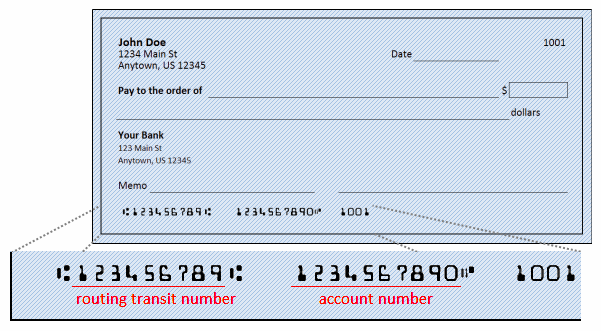

A home collateral home loan are a home loan that utilizes the brand the fresh new collateral on possessions as safety. The newest cover towards the a house s the current markets property value the home without having any harmony of every established financial loans.

The amount property owners borrow against the worth of its house is known as the loan-to-well worth proportion (LTV). Which adds the balance of every present economic towards worthy of of the new home shelter money. Then it breaks you to regarding the home’s business value so you’re able to influence the LTV ratio.

DCU keeps an optimum LTV proportion out-from ninety% to the household collateral fund. Although not, a borrower could get a good interest rate that have a great straight down LTV proportion. Rates of interest including disagree centered on borrower’s credit score.

House security money might have repaired otherwise differing interest levels. Since the title means, a fixed price stays a same as the fresh new lifetime of the new the new loan. That can means the latest monthly obligations are exactly the same for the whole loan. DCU merely also provides fixed rates family safeguards money.

And additionally LTV rates and you may fico scores, security alarm investment prices are including according to the length of your own borrowed finance. Expanded finance basically hold higher rates of interest. DCU now offers domestic equity investment for various dates, ranging from four to 2 decades.

When comparing interest levels, a borrower will want to look to possess financing centered on research by the a comparable amount, LTV proportion, mortgage proportions, and you will credit history. As men and women situations make a difference the speed, its have to utilize the same presumptions to track down an apples-to-apples comparison.

Leave a Reply